... do balance sheets matter with interest rates so low? EXECUTIVE SUMMARY

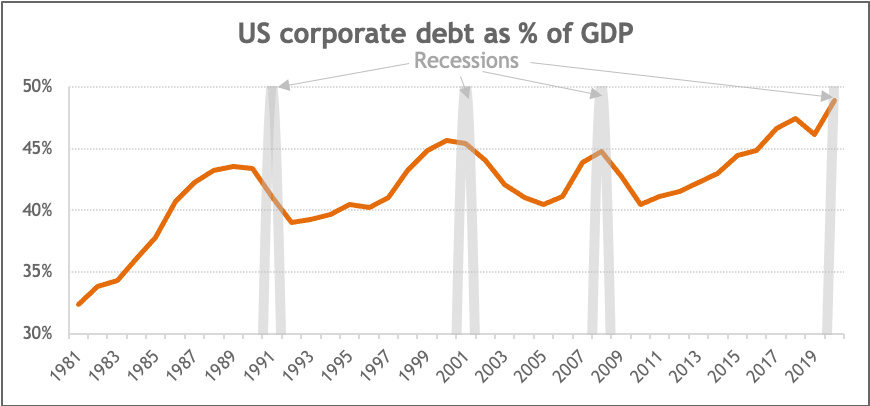

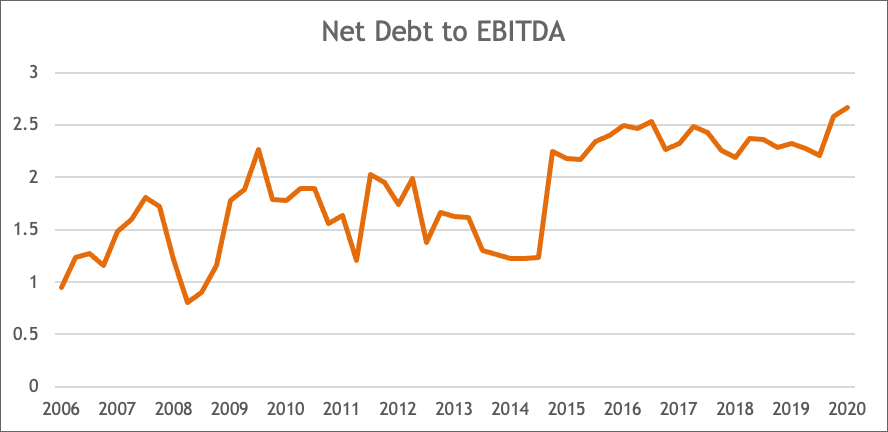

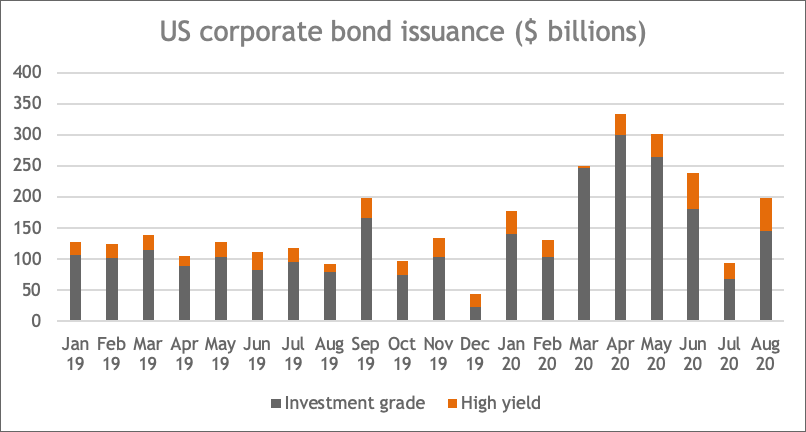

Pandemic triggered stimulus … Global equities plunged over 30% in early spring due to the COVID-19 pandemic, but since then staged a miraculous recovery, fueled by an unprecedented monetary and fiscal policy response. However, the story does not end there. The longer-term effects of the lockdown and fears of a second wave create uncertainty, potentially leading to permanent job losses and a negative impact on economic output. The answer from governments is more stimulus, especially infrastructure programs – financed by debt.[1] In March, the Federal Reserve announced that it would use up to $300 billion to support the flow of credit to companies – on top of the $700 billion budget for Treasury and mortgage-backed securities – by issuing loans and purchasing investment-grade corporate bonds through an SPV.[2] Fallen angels, corporates recently downgraded from investment grade, were included in an extension of the program shortly after that. These actions saved many companies and the economy from the worst impacts of the pandemic. However, they also led to a debt bonanza. As a consequence, we see an increase in the indebtedness of corporates and sovereign states - from a level that was already historically high. [1] https://www.schwab.com/resource-center/insights/content/2020-mid-year-outlook-corporate-bonds [2] https://www.federalreserve.gov/newsevents/pressreleases/monetary20200323b.htm Figure 1. Sources: fred.stlouisfed.org, apps.bea.gov, HCP Asset Management … which is translating into dramatically higher debt levels To see the big picture, it is worthwhile to first look at the starting point before the pandemic: already high and increasing levels of debt. Figure 1 shows the rise of US corporate debt, including loans, as a percentage of the US GDP, marking recessions and the sharp increase and subsequent decline of debt levels. At the start of 2020, before the pandemic hit the world, US corporate debt was already close to 50% of US GDP. The trend of increasing corporate indebtedness is not a US specialty; it is a global phenomenon. Figure 2 demonstrates the increase of global net debt to EBITDA (proxied by the MSCI World Index), hitting an all-time-high of 2.7x in the 2nd quarter of 2020. Figure 2. Sources : Bloomberg, HCP Asset Management During the pandemic, as part of the fight to save the economy and most importantly, jobs, many companies issued new debt securities taking advantage of the FED’s promise to purchase corporate bonds. New issuance of corporate bonds increased by 79% in the first eight months of 2020, compared to the same period last year. Between March-August 2020 US firms issued new bonds for over $1.2 trillion, 15% of which fall in the high yield category according to the data of SIFMA, the American trade association. Issuance of junk bonds hit a new record with over $50 billion in June, beating by far the last monthly record of $40.8 billion in September 2012.[1] [1] https://www.marketwatch.com/story/sales-of-junk-bonds-hit-record-in-june-as-debt-saddled-corporations-rush-to-raise-cash-2020-06-30

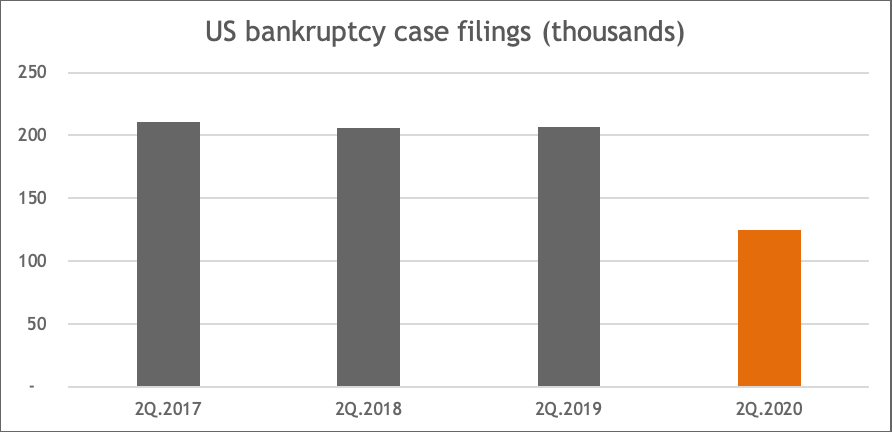

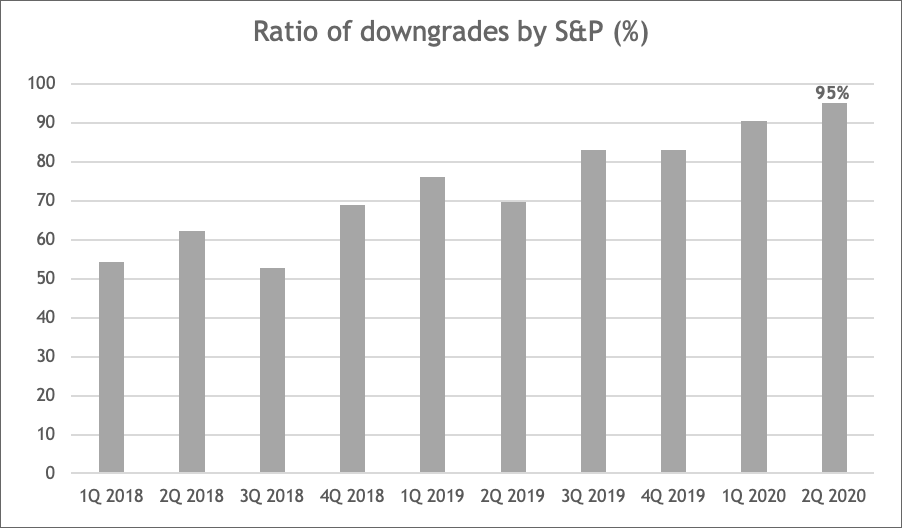

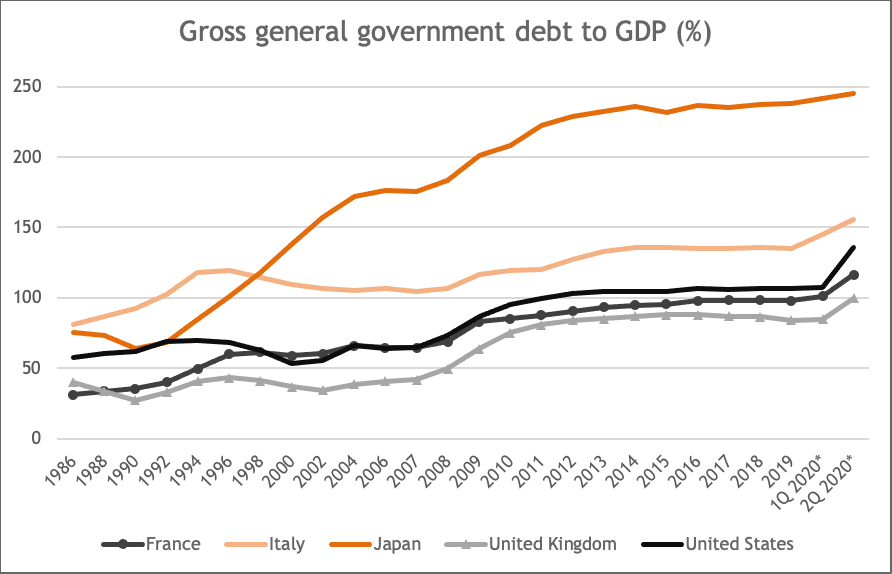

Figure 5. Zombie companies on the rise! Another reason for worry is the constant rise of zombie companies: Their ratio increased from 2% in the '90s to 8% in 2018, and spiked lately to 18-20%, a number indicating serious, postponed problems. Reduced financial pressure and low interest rates are the hotbed of zombie stocks, typically associated with weak productivity and debt bubbles. The presence of zombies is harmful to the economy as they use valuable resources unproductively, crowding out more productive companies and slowing down general growth. Based on the above warning signs – increasing debt, missing bankruptcies and zombies -, we should not be surprised to see the numbers of distressed companies rising in the coming quarters. In government stimulus we trust? The future development of the economy – especially in case of a second wave of the pandemic - depends massively on the injection of further support coming from governments and central banks. The issue is that sovereign debt levels are also hitting records, with record sovereign credit downgrades and defaults at the same time. How are public authorities to finance the economy, keeping promises of stimulus and gigantic infrastructure projects for the long-term? Countries reliant on commodities or tourism are especially endangered. Argentina, Ecuador and Lebanon already have defaulted on sovereign debt this year, equaling the record high of 3 defaults in 2017 by Fitch. The agency downgraded 29 countries in the first four months, out of which eight are now rated CCC or worse, with a low chance to avoid default. Fitch expects more defaults to occur this year and warns that a sharp increase in sovereign debt may be a sign of coming troubles. Sovereign debt relative to GDP of the leading developed countries such as Japan, US, UK, Italy, France – selected as examples – are all increasing. The recent uptick of the ratio shows that the COVID-19 crisis caused governments to increase their debt burden, while GDP is shrinking significantly. Optimists argue that there is more room before all countries reach the levels of Japan, and the Fed is willing to finance the US deficit by buying back the issued debt. Only history will tell how this large-scale experiment ends. Figure 6. Sources: IMF and other sources, HCP Asset Management (for Q1, Q2 2020 which are partially estimates). Balance sheets matter Companies with great balance sheets have outperformed the overall market since its February high and its subsequent low on March 23. The universe of firms with no net debt outperformed the MSCI World by 9 % since the March 23, 2020 low, and even 12% since the Feb 12, 2020 high.[1] HCP focusses on precisely this balance sheet quality; it is at the heart of our approach. We believe that balance sheet quality will become of even greater relevance going forward. Conclusion The global economy is floating on a sea of increasing and deteriorating corporate and sovereign debt – investors need to be very careful. Now up to one out of five companies is estimated to be a zombie and might be the next one to go bankrupt. Governments are playing a risky game, with defaults and downgrades hitting new records in modern history – nobody can tell how long they can keep the economy floating. Today, investors deeply care about sustainability: how is this level of indebtedness to be sustained or managed long term? However, how is the current level of debt compatible with good governance, the “G” in ESG? ESG must also incorporate the analysis of debt levels. Furthermore, how can we expect passive investments to perform well if the economy is floating on printed debt? Active management seems better positioned to pick the right, healthy firms and thus avoiding the most indebted firms. The HCP strategy is to focus on companies with healthy balance sheets as we believe that in a debt bubble, investors should not give up on quality even if debt service levels are low. As we have shown, the market seems to agree. Learn more about our strategy at www.hcp.ch [1] Source: Bloomberg, Universe: Companies with net cash and a market capitalization of 1 bn USD or more Legal disclaimer This communication is issued by HCP Asset Management S.A.(”HCP”). This communication is provided for informational purposes only and does not constitute an offer or a recommendation to purchase or sell any security or service. It is not intended for distribution, publication, or use in any jurisdiction where such distribution, publication, or use would be unlawful. This communication does not contain personalized recommendations or advice and is not intended to substitute any professional advice on investment in financial products. Investments are subject to a variety of risks. Before entering into any transaction, an investor should consider carefully the suitability of a transaction to his/her particular circumstances and, where necessary, obtain independent professional advice in respect of risks, as well as any legal, regulatory, credit, tax, and accounting consequences. Past performances is no guarantee of current or future returns, and the investor may receive back less than he/she invested. This communication is the property of HCP and is addressed to its recipients exclusively for their personal use. It may not be reproduced (in whole or in part), transmitted, modified, or used for any other purpose without the prior written permission of HCP. The contents of this communication are intended for persons who are sophisticated investment professionals and who are either authorised or regulated to operate in the financial markets or persons who have been vetted by HCP as having the expertise, experience and knowledge of the investment matters set out in this document and in respect of whom HCP has received an assurance that they are capable of making their own investment decisions and understanding the risks involved in making investments of the type included in this communication or other persons that HCP has expressly confirmed as being appropriate recipients of this communication. If you are not a person falling within the above categories you are kindly asked to either return this document to HCP or to destroy it and are expressly warned that you must not rely upon its contents or have regard to any of the matters set out in this communication in relation to investment matters and must not transmit this communication to any other person. This communication contains the opinions of HCP, as at the date of issue. The information and analysis contained herein are based on sources believed to be reliable. However, HCP does not guarantee the timeliness, accuracy, or completeness of the information contained in this communication, nor does it accept any liability for any loss or damage resulting from its use. All information and opinions as well as the prices indicated may change without notice. Neither this document nor any copy thereof may be sent, taken into, or distributed in the United States of America, any of its territories or possessions or areas subject to its jurisdiction, or to or for the benefit of a United States Person. For this purpose, the term "United States Person" shall mean any citizen, national or resident of the United States of America, partnership organized or existing in any state, territory or possession of the United States of America, a corporation organized under the laws of the United States or of any state, territory or possession thereof, or any estate or trust that is subject to United States Federal income tax regardless of the source of its income. Source of the figures: Unless otherwise stated, figures are prepared by HCP. Although certain information has been obtained from public sources believed to be reliable, without independent verification, we cannot guarantee its accuracy or the completeness of all information available from public sources. Views and opinions expressed are for informational purposes only and do not constitute a recommendation by HCP to buy, sell or hold any security. Views and opinions are current as of the date of this communication and may be subject to change. They should not be construed as investment advice. No part of this material may be (i) copied, photocopied or duplicated in any form, by any means, or (ii) distributed to any person that is not an employee, officer, director, or authorised agent of the recipient, without HCP Asset Management S.A. prior consent. ©2020 HCP Asset Management S.A.. All rights reserved

2 Comments

|

AuthorBolko Hohaus Archiv

December 2023

Categories |

||||||||

RSS Feed

RSS Feed