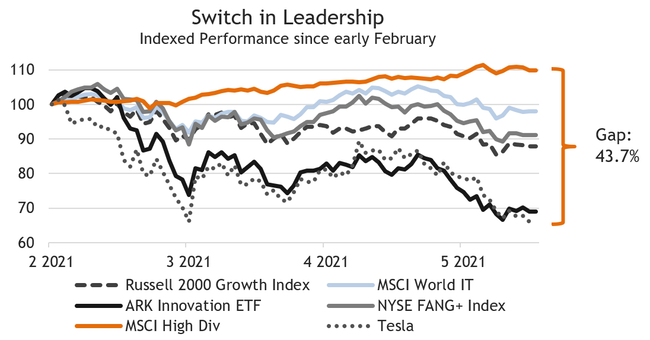

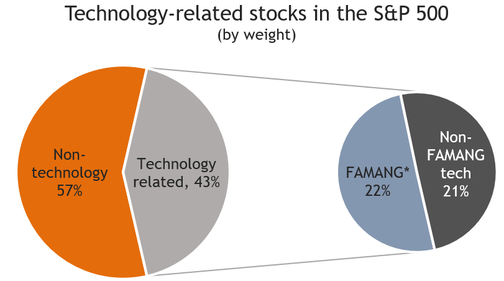

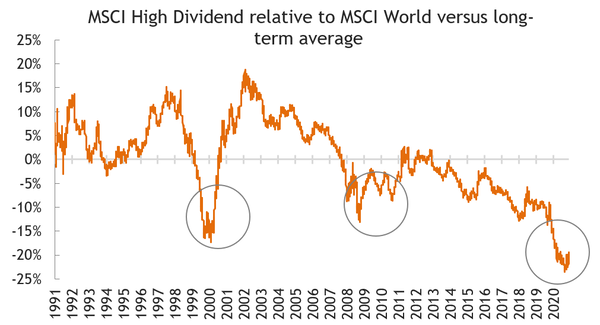

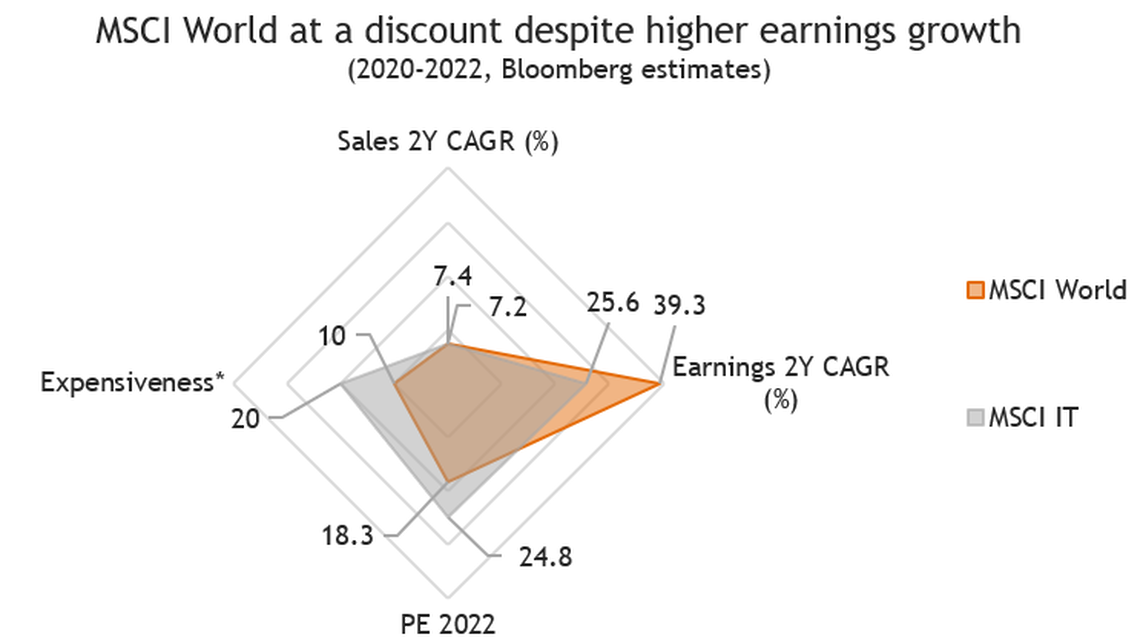

Photo by Greg Rosenke on Unsplash They said it is different this time Early February, we published our viewpoint ”Time for a change?” in which we argued that a rotation away from the highfliers of 2020 was very likely and probably imminent. Equity income stocks were trading at a uniquely attractive entry point, only seen twice before in the last thirty years. Since then, the Russell 2000 growth index fell 12 %, while the MSCI High Dividend Index advanced 11 % (see chart one). This is a spectacular delta of 23 % in a bit more than three months - time to revisit our thesis. We argue in this viewpoint that we are still early in a transition that is likely to last for many years to come, if not the next decade. Over the last five years, the Russell growth index has (erase) outperformed the MSCI High Dividend index by more than 70 %. The delta in favor of technology over that period was even a proper 200 %. As valuation for disruption stocks skyrocketed in 2020, taking profits and reinvesting the money in attractively valued equities seems to be a prudent move.  Chart 1: Growth is lagging, Equity Income leading Source: HCP, Bloomberg (Russell 2000 Growth. MSCI World High Dividend). Start Date is 5.2.2021, the publication of our last HCP viewpoint. Digital detox and the real stuff getting scarce We all know that we live in disruptive times and that the pandemic accelerated the digital adoption. However, investors priced many technology companies for very strong growth over long time periods. Scores of companies profited from being seen as concept stocks with no need to show profitability. The share of those money-losing companies reached levels last time seen in the Y2K bubble. However, in the imminent grand reopening, humans are likely to digitally detox. Companies need to get their hands on materials such as steel, lumber or copper to build their products. Higher input prices here will leave them with less budget for the rest, such as technology. Consumers also just upgraded their home office and technology gear. That does not imply IT budgets will shrink in 2021, but their growth rate is likely to decline from a year that showed a tremendous acceleration. This will be a strong headwind for technology stocks. Tech earnings lagging In 2021, the technology sector will lag in terms of relative earnings growth versus the overall market. To smooth the rebound effect of 2021, we aggregated in chart two the numbers for 2021 and 2022. Technology is still expected to grow less than the market over this longer period. This is true both for revenues and earnings. At the same time, the technology sector trades at a significant valuation premium that a price to earnings growth ratio does not seem to justify. Furthermore, the well-known mega-tech companies Facebook, Apple, Amazon, Google are potentially facing anti-trust action and higher tax rates from governmental efforts to restrict the current global tax optimisation. Therefore, it will be critical to watch the development of this group of companies as they were a key driver of earnings growth for the sector over the last five years (in our last viewpoint, we showed that the FATMANG group actually contributed all of the sector’s earnings growth). * Rescaled PEG 2022 calculated as 20x PE Ratio to 2-year CAGR of estimated EPS Chart 2: Technology earnings growth lagging in 2020-2022 (Source: HCP, Bloomberg) Tighter regulation a key threat On top of the slower near-term tech earnings, tighter regulation is becoming a reality for the sector. The new US administration has nominated Lina Khan as Federal Trade Commissioner (FTC), an outspoken tech critic. The US department of justice has an anti-monopoly case running against Alphabet, and the FTC sued Facebook for illegal monopolization. At the same time, Apple gets attacked by Fortnite producer Epic for its app store take rates that are deemed excessive by smaller content owners and have brought Apple tremendous traffic growth. Amazon is just considering acquiring MGM, entering a new business area (film production). With the tech giants expanding, conflicts with smaller companies and anti-trust concerns are likely to become more widespread. However, the exact timing of any governmental action and what type of actual measures will be taken are uncertain. The regulator may break up the large tech companies or restrict data collection as consumer concerns are constantly rising. Furthermore, the US administration has proposed a minimum tax rate of 15 %, undermining the global tax optimization efforts of the tech giants. It seems safe to assume that the median tax rate for large companies that halved over the last thirty years will not fall further. The S&P is soon 50 % tech; Tech is half FAMANG (Facebook, Apple, Microsoft, Amazon, Netflix, Google) Passive investors that buy an S&P tracker should be aware that soon half of the index consists of tech or tech-related (i.e. communication services) companies (see chart 3). In that calculation, we did not even include firms such as Tesla, seen by some as a technology company powering the operating system of the mobile society of the future. Furthermore, half of the current market cap of technology-related stocks consists of the FAMANG stocks. Hence, the fate of those companies will determine the direction of the sector in the future. We are all aware of the performance of the tech giants over the last few years, but historically, half of the top 20 companies did not make it to that group a decade later. Hence, some caution towards the FATMANG group might be appropriate.  * Not including Tesla Chart 3: Tech heavy S&P 500; FAMANG half of technology Source: HCP, Bloomberg (S&P 500) The implications are two-fold. Once the large-cap techs struggle, technology and the S&P are likely to be under pressure. Secondly, passive investing may lose the decade-long tailwind from the bigger companies taking share – an excellent opportunity for active asset managers may arise. Worthwhile to consider equity income for contrarians What other parts of the market may take the leadership in 2021 in a world that hopefully will recover from the pandemic during the year? Looking at Chart 4, we can see that equity income stocks still trade close to a multi-decade low versus the overall market – measured by the MSCI High Dividend versus the MSCI World. In our view, it is an excellent opportunity to re-evaluate this universe as the last time that the index traded close to such a discount to the broad market, the equity income index started a multi-year outperformance. Since we had written about this in early February, the MSCI High Dividend Index has outperformed the Russell 2000 growth index by more than 2000 basis points! This move is barely visible on the chart, indicating that this reversal has only started with a lot of potential for the following years, in our view.  Chart 4: MSCI High Dividend versus MSCI World still close to all-time lows Source: HCP, Bloomberg (MSCI) Conclusion: It is unlikely to be different this time; the rotation has only started With the market trading like a thirty-year bond with a 2 % yield as some describe it, higher rates will be a headwind as the rise in the discount factor reduces the current value of future cash flows. This implies that investors should change focus from highly-priced growth stocks to market segments that have valuation support. Given the vast outperformance in technology stocks over the last years and the change of relative earnings growth patterns, we believe that it is time to start allocating to other equity universe buckets. Equity income shares are trading close to an all-time low versus the overall market. The last time this has happened, the fate reversed for many, many years in a row. That does not mean that one has to invest in any high dividend stock blindly. Every investment needs to be carefully screened if the underlying company has still a viable business model and can generate strong cash flows over time. In a portfolio, it makes sense, in our opinion, to have a barbell strategy that, on one side, focusses on innovation as long as valuations for the selected companies are realistic. Still, now an equity-income portion seems to be a very attractive addition on the other side of equities’ risk spectrum. The outperformance of this segment has already started, but we outlined why we think it is still early, in our view. Disclaimer: This document is a marketing document and is intended for informational and/or marketing purposes. This document is addressed solely to Recipients to whom it has been delivered by HCP Asset Management SA (“HCP”). It may not be distributed in whole or in part to any other persons without the prior written consent of HCP. All Recipients take full and sole responsibility for compliance with applicable laws and regulations in relation to any use they make of the Document. This Document contains information about the certificate but does not constitute an issuance prospectus pursuant to articles 652a or 1156 of the Swiss Code of Obligations, article 7 ff. of the Swiss Federal Act on Collective Investment Schemes or a similar law or regulation. The complete information on the certificate, including the relevant risks, can be obtained from the simplified prospectus, which can be retrieved from www.ubs.com/keyinvest and which constitutes the sole binding basis for an investment decision. The Document is for general informational purposes only. Nothing contained in this Document constitutes legal, tax or investment advice. The information in this Document does not constitute an offer, solicitation or recommendation to buy or to sell the certificate or any other financial instruments, or to engage in any other transaction involving financial instruments. Before making an investment decision the Recipient should always read all relevant legal documents (e.g. the simplified prospectus) as well as any other material which might be required under local laws and regulation, especially all relevant risk disclosures contained therein, and seek professional advice. Any investment decision lies in the sole responsibility of the Recipient. Past performance is no guarantee for future performance. HCP provides no guarantee whatsoever pertaining to the future performance of the certificate. Although the Document is based on information that HCP considers to be reliable, HCP does not guarantee that the content is accurate, up-to-date or complete. HCP may amend the Document partly or entirely at any time without prior notice. HCP is not obliged to provide the Recipients with an amended version of the Document.

0 Comments

Leave a Reply. |

AuthorBolko Hohaus Archiv

December 2023

Categories |

||||||

RSS Feed

RSS Feed