|

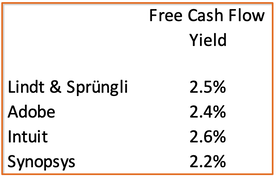

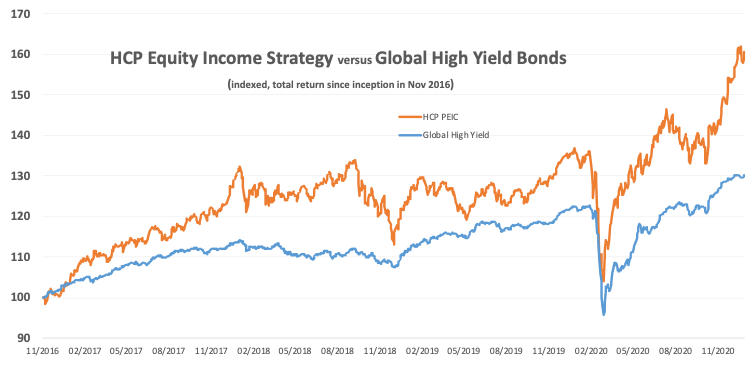

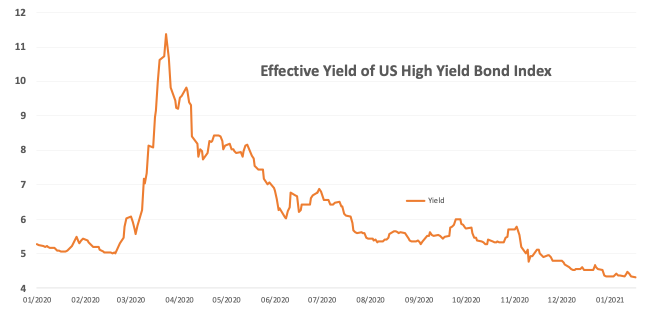

Where to generate income in this low-yield world? Imagine a saver with one million CHF in assets approaching her retirement and wanting to generate steady, not too risky returns from her savings. In the past, she would have invested the majority of her capital in bonds: mostly Swiss government bonds, some non-Swiss bonds, some corporates. These times are over with Swiss and German government bonds yielding -0.5 %, and even high-quality corporate bonds like Nestlé negative at -0.2 %. Of course, she could turn to high-yield bonds which currently offer 4.2 % in the US and 2.6 % in Europe. However, in a world with ever-increasing debt levels, this implies investing in highly leveraged companies in often structurally challenged sectors. Losing only one investment in a portfolio of thirty bonds erases the whole return, not even thinking about a blow-out in spreads which could create capital losses of twenty percent plus. Given that lack of alternatives, HCP has developed an innovative approach that has shown to deliver consistent returns since its inception in 2016. We call it the “Premium Equity Income Approach”. In our core strategy, this portfolio has paid a dividend of 6 % every year out of its annual total return of around 12 %. The saver in our example would have received a yearly dividend of 60’000 CHF and achieved additional capital gains of the same amount. The even better news is that the pay-out consists mostly of capital gains and is, therefore, income-tax-free for Swiss citizens. Where else can savers in need of sustainable income find these kind of yields in liquid instruments? Snails and more How is this possible? HCP carefully selects roughly thirty global companies that are not leveraged and generate sustainably high free cash flow. That way, the investors get exposure to a well-diversified equity portfolio of healthy companies with great balance sheets. As a total, that portfolio of companies generates a bond-like cash flow of more than 6 % p.a. despite those firms not being leveraged and not bearing major credit risks. One way to look at it would be a virtual 6 % paying bond of a group of companies with a top credit rating. However, as they do not have net debt, there is actually no credit rating for many of them. As those companies do not pay out 6 % on average, we augment our strategy by a yield enhancement on roughly one-third of our holdings. We call them “snails”, slow-moving, steadily cash-flow generating companies. On those rather boring stocks we sell call options and collect the call premium, which allows us to pay out the dividend that we target to be at least 5 % p.a. Over the first four years, we exceeded our objective and distributed 6 % p.a. Premium Equity Income Strategy in 2020 versus Equity Markets and High Yield Bonds How has our income-oriented strategy fared in a year like 2020? The HCP Premium Equity Income Certificate USD (PEIC) delivered a total return of +15.9 %, in-line with world equity markets but much better than the underlying universe that was flat in 2020 (as measured by the MSCI High Dividend). Notably, even the drawdown in March was one-third smaller than equity markets and in-line with defensive Swiss large caps such as Nestlé. Hence, in a challenging year, the focus on companies with healthy balance sheets and strong cash flows has proven to be again an excellent strategy to reduce risk while achieving significant returns. With bond yields collapsing, the search for yield has become more complex. We see clients increasingly using our strategy to replace their high yield bond allocations. Chart 1 shows that PEIC had a similar drawdown despite being a different asset class, but a total return twice that of the Global High Yield Index (+61 % versus +30 % since inception). Chart 1: HCP’s income strategy as replacement for high yield bonds? Source: HCP, Bloomberg (Global Bond High Yield Index: Barclays) Chart 2: US High Yields trading at all-time low yields Source: HCP, Federal Reserve Bank of St. Louis (US High Yield) The ‘Hunt for Yield’ has driven the yield of high yield bonds to an all-time low (see chart 2). The move to lower yields has at the same time supported equities, especially growth stocks which now trade at meagre free cash flow yields. Businesses such as Adobe or Intuit are seen as stable enough to afford them a 40x cash flow multiple. They are like a bond proxy trading with a small 150 bps equity premium to the US long bond. Table 1 highlights a few stocks trading in that range. Many other high-flying stocks are not even profitable, but their valuation has dramatically increased as their discount rate has plummeted. Those valuations leave little cushion for error or a significant move higher in rates. Therefore, we advocate to focus on businesses with sustainable high free cash flow yields as their low valuation is more attractive and provides a margin of safety.  Table 1: Free Cash Flow yields of selected stocks Source: HCP, Bloomberg Conclusion: Low yields and the demographic-driven demise of the pension system require new solutions In a low-yield world, new investment solutions need to be found to secure income for investors in need of it. With increasing life expectancy, the pension system as it is currently constructed will likely fail to provide enough income for retirees. The HCP solution tries to address not only the shortfall of pensions stemming from the demographic challenges; it also offers a way to generate cash flow from an investment portfolio. This regular dividend can be used to pay for children’s or grandchildren’s education or back up an affordability calculation for a mortgage, to give only two examples. Notably, the equity market can be volatile over the short-run, but markets have historically always recovered over time. Therefore, we believe that HCP’s equity income approach deserves a place in investors’ asset allocation as a more defensive equity building block providing steady income. Disclaimer: This document is a marketing document and is intended for informational and/or marketing purposes. This document is addressed solely to Recipients to whom it has been delivered by HCP Asset Management SA (“HCP”). It may not be distributed in whole or in part to any other persons without the prior written consent of HCP. All Recipients take full and sole responsibility for compliance with applicable laws and regulations in relation to any use they make of the Document. This Document contains information about the certificate but does not constitute an issuance prospectus pursuant to articles 652a or 1156 of the Swiss Code of Obligations, article 7 ff. of the Swiss Federal Act on Collective Investment Schemes or a similar law or regulation. The complete information on the certificate, including the relevant risks, can be obtained from the simplified prospectus, which can be retrieved from www.ubs.com/keyinvest and which constitutes the sole binding basis for an investment decision. The Document is for general informational purposes only. Nothing contained in this Document constitutes legal, tax or investment advice. The information in this Document does not constitute an offer, solicitation or recommendation to buy or to sell the certificate or any other financial instruments, or to engage in any other transaction involving financial instruments. Before making an investment decision the Recipient should always read all relevant legal documents (e.g. the simplified prospectus) as well as any other material which might be required under local laws and regulation, especially all relevant risk disclosures contained therein, and seek professional advice. Any investment decision lies in the sole responsibility of the Recipient. Past performance is no guarantee for future performance. HCP provides no guarantee whatsoever pertaining to the future performance of the certificate. Although the Document is based on information that HCP considers to be reliable, HCP does not guarantee that the content is accurate, up-to-date or complete. HCP may amend the Document partly or entirely at any time without prior notice. HCP is not obliged to provide the Recipients with an amended version of the Document.

1 Comment

1/18/2023 12:54:43 pm

Excellent article! Thank you for your excellent post, and I look forward to the next one. If you're seeking for discount codes and offers, go to couponplusdeals.com.

Reply

Leave a Reply. |

AuthorBolko Hohaus Archiv

December 2023

Categories |

||||||

RSS Feed

RSS Feed