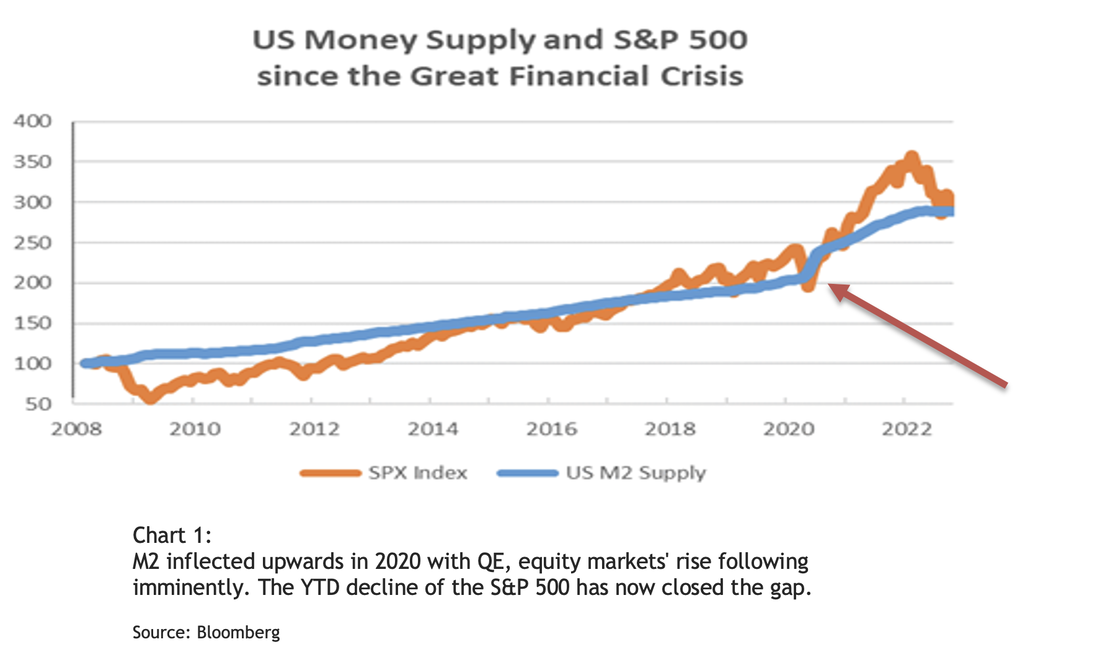

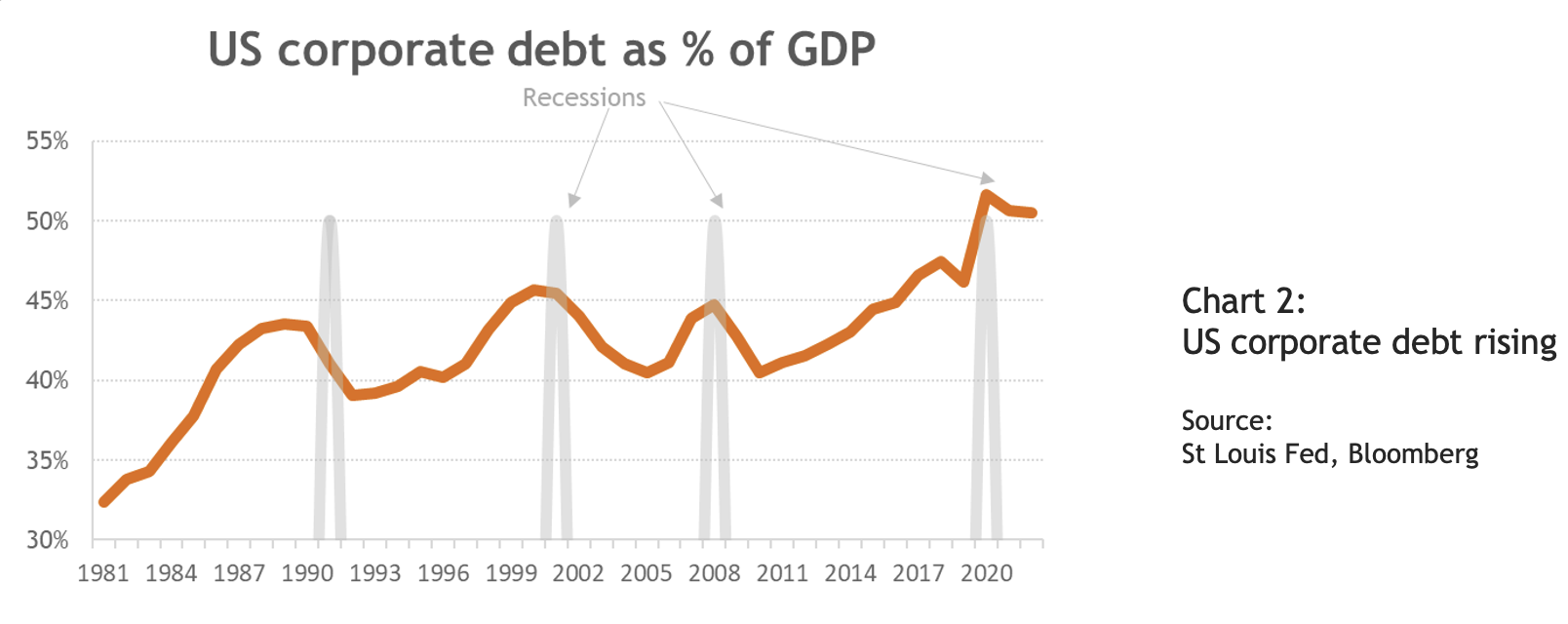

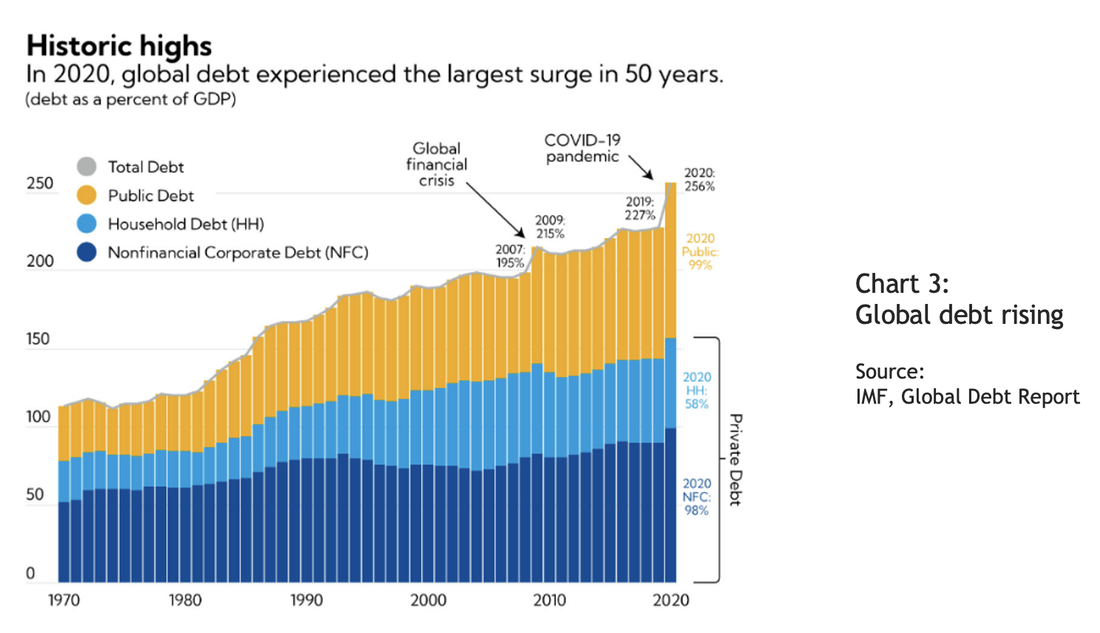

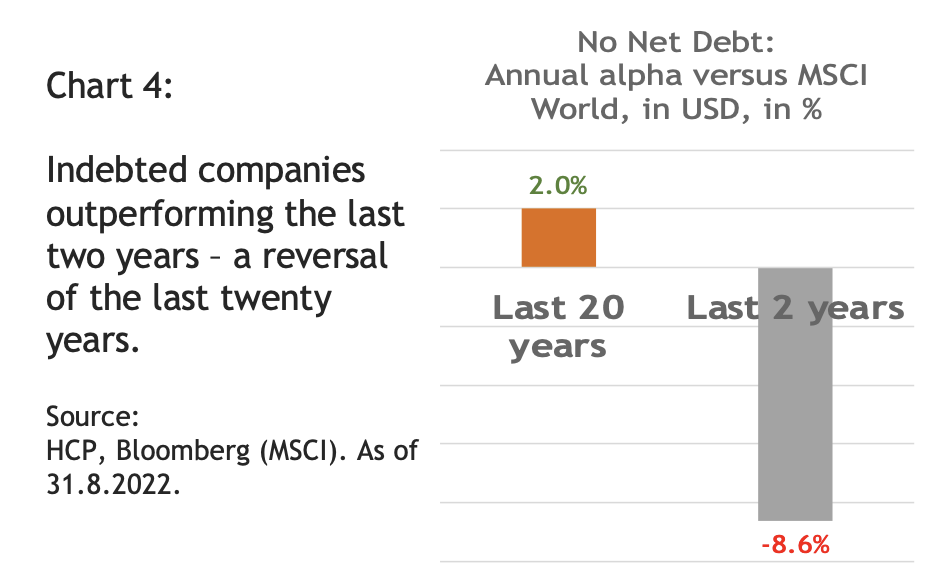

QT - The end of the debt rushQuantitative Tightening (QT) has arrived In June, the US Fed has started to shrink its balance sheet by letting treasuries and mortgage-backed securities (MBS) mature without reinvesting the proceeds. The pace of this tightening is supposed to accelerate significantly this month, with the amount rolling off the balance-sheet doubling compared to June. As Powell indicated that QT should last two to two ½ years, the total amount the Fed’s assets are supposed to shrink is about 2-2.5 trillion US-$, versus the current assets of US-$ 9 trn (that equal 40 % of US GDP). Any effects on liquidity may not arrive immediately as it depends who is the buyer of newly issued treasuries but net treasury supply is also estimated to triple to 1.5 trn a year versus the pre-Covid year 2019. The Fed already owns a third of all outstanding treasuries and may not be able to continue its purchases at the same pace. Over time, the impact of QT on liquidity is, therefore, likely very restraining, influencing upward pressure on bond yields. Chart 1 shows how QE has not only lifted M2 but also equity markets as the latter inflected upwards with increased money supply. Hence, the opposite effect over the QT period seems quite possible. Low interest rates lead to market participants taking on more debt While the interest burden is relatively low given the S&P 500 net debt to EBITDA ratio of 1.2, corporate debt as % of GDP is now 10 %-points higher than at the end of the great financial crisis (see chart 2). With rates rising fast, there is a risk that part of the debt becomes unbearable over the next few years. If EBITDA was to drop by one third in a recession, net debt to EBITDA would rise to 1.8 – a still acceptable level for the average company but this is only the average. Consequently, balance sheets will become important again in selecting companies as many will run into trouble in a recession. Global debt levels rising On a global level, debt, especially public debt, saw a huge increase during the pandemic (see chart 3). This likely implies higher taxation and lower net profit margins down the road. On the other hand, governments have now every incentive to keep interest rates lower, implying fiscal repression tactics to become more common. Investors rushing out of companies without debt Many companies used the period of low interest rates to shore up its cash balances by issuing debt over the last two years. That has lead to a very unusual underperformance of those companies with cash (chart 4). We expect this anomaly to disappear again, and requires investors to adapt. Conclusion: QT likely to impact market for some time – balance sheets to matter again Higher rates are a headwind for equities as the rise in the discount factor reduces the current value of future cash flows. This implies that investors should change focus from highly-priced growth stocks to market segments with valuation support. Furthermore, balance sheet quality, as measured by net cash, has been largely ignored by investors in the pandemic world. With QE ending and QT starting, this should normalize again. Human beings tend to perceive the world in a linearly; hence we are still in the early innings of this adjustment process.

1 Comment

William Ramstein

9/21/2022 05:12:11 pm

"Consequently, balance sheets will become important again in selecting companies as many will run into trouble in a recession." + a squeeze on profit margins make me wonder if startups who focus on products that facilitate better inventory management, pricing insight, or liquidity/capital market solutions for SME could become prime targets for M&A.

Reply

Leave a Reply. |

AuthorBolko Hohaus Archiv

December 2023

Categories |

||||||

RSS Feed

RSS Feed