|

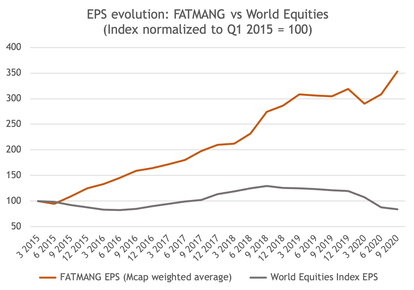

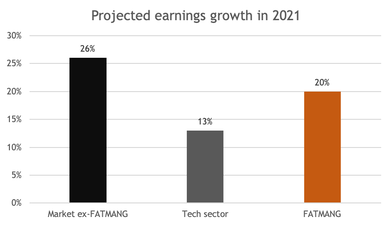

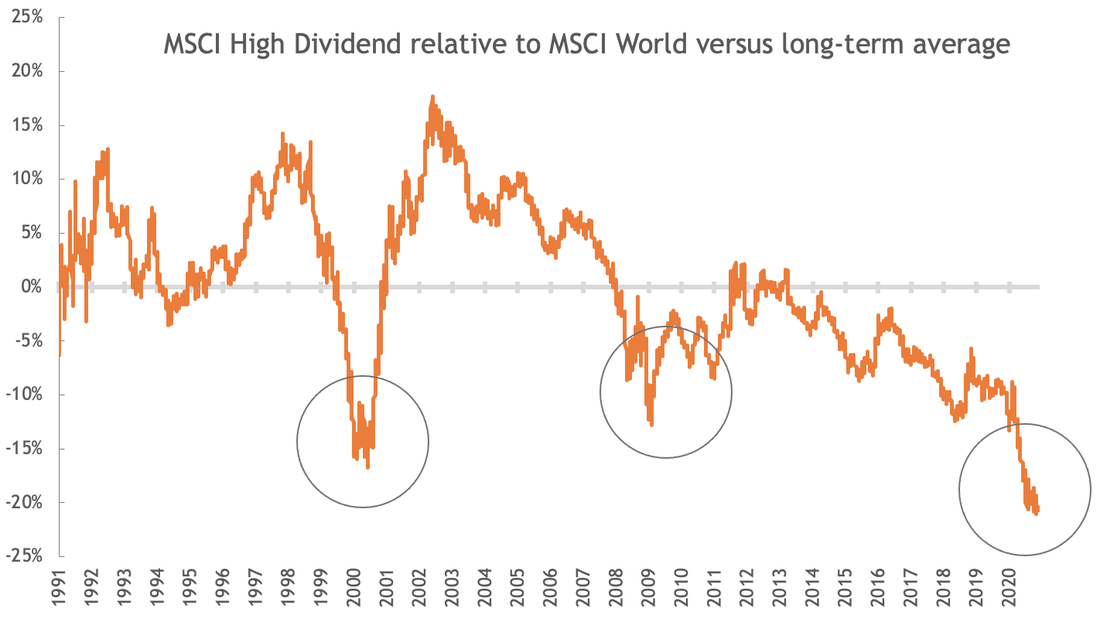

Is it different this time? In 2020, the upside in markets had been mainly in thematic, mostly technology equities. The technology sector index advanced 44 %, outpacing the broad market’s gain of 17 % by a wide margin. A pandemic-driven acceleration of the already ongoing digital disruption trend led to a significantly higher sector valuation as technology was seen as a safe haven. Despite this, aggregated sector revenues and earnings were falling year over year in 2020. Hence, investor priced in higher expectations for the future. With vaccines hitting the market at this very moment, it seems likely that investors’ focus will shift to other areas during 2021. Please read on to learn what are arguments against and for this change of focus, and what our opinion is. The pandemic has created for every company and organization the need to implement a clear digital strategy. Often this was even a question of survival for the pandemic-affected entities. The consequent redirection of budgets to digital projects has accelerated growth for many technology companies in 2020 and beyond as projects are rolled out over time. However, on a sector level, there was no revenue and earnings growth for technology last year. For those companies gaining last year revenue share, year over year comparisons in 2021 will become tougher while at the same time valuations often price in a rosy picture for many years to come. Markets tend to look for accelerating growth, the second derivative, for those highfliers. It creates a significant challenge to the sector’s leaders’ forward performance. Earnings growth dispersion To get a clearer picture, let us look at the composition of equity markets’ earnings growth over the last five years. There was no earnings growth outside of the well-known mega-tech companies (called FATMANG or Facebook, Apple, Tesla, Microsoft, Amazon, Netflix, Google), see chart 1. Therefore, it will be critical to watch the development of this group of companies.  Chart 1: A world without earnings growth – except the FATMANGs Source: HCP, Bloomberg (MSCI World) Tech sector with subpar earnings in 2021 & tighter regulation a key threat What may be a surprise to many: according to consensus tech sector earnings in 2021 will lag the market. Even the FATMANG group’s earnings growth will not keep up with the rest of the market. Hence, 2021 will be the first year for more than five years, where the relative growth trajectory between FATMANG and the market reverses. Given their share of the market (around 15 % of the total market capitalization), this could significantly affect indices. On top of that, tighter tech regulation is becoming more likely. Even in the US, we see initiatives with that goal. However, the exact timing and what type of actual measures will be taken are uncertain. The regulator may break up the large tech companies, or restrict data collection. However, it is not only the governments that are looking to take actions. The recent changes in WhatsApp’s general conditions initiated by its parent company Facebook have triggered a massive outflow of clients to alternatives such as Telegram, Signal or Threema. It clearly shows that users are becoming increasingly wary of sharing data with Big Tech. If users were to demand money for sharing data, the tech giants’ model could dramatically be challenged.  Chart 2: Technology earnings growth lagging in 2021 Source: HCP, Bloomberg Worthwhile to consider equity income for contrarians What other parts of the market may take the leadership in 2021, in a world that hopefully will recover from the pandemic during the year? Looking at Chart 3, we can see that equity income stocks trade at a multi-decade low versus the overall market – measured by the MSCI High Dividend versus the MSCI World. In our view, it is an excellent opportunity to re-evaluate this universe as the last time that index traded close to such a discount to the broad market, the equity income index started a decade-long outperformance.  Chart 3: MSCI High Dividend versus MSCI World at all-time lows Source: HCP, Bloomberg (MSCI) Conclusion: The odds are that it is not different this time Given the vast outperformance in technology stocks over the last years and the change of relative earnings growth patterns, we believe that it is time to start allocating to other equity universe buckets. Equity income shares are trading at an all-time low versus the overall market. The last time this has happened, the fate reversed for many, many years in a row. That does not mean that one has to invest in any high dividend stock blindly. Every investment needs to be carefully screened if the underlying company has still a viable business model and can generate strong cash flows over time. In a portfolio, it makes sense, in our opinion, to have a barbell strategy which on one side focusses on innovation as long as valuations for the selected companies are realistic. Still, now an equity-income portion seems to be a very attractive addition on the other side of equities’ risk spectrum. Disclaimer: This document is a marketing document and is intended for informational and/or marketing purposes. This document is addressed solely to Recipients to whom it has been delivered by HCP Asset Management SA (“HCP”). It may not be distributed in whole or in part to any other persons without the prior written consent of HCP. All Recipients take full and sole responsibility for compliance with applicable laws and regulations in relation to any use they make of the Document. This Document contains information about the certificate but does not constitute an issuance prospectus pursuant to articles 652a or 1156 of the Swiss Code of Obligations, article 7 ff. of the Swiss Federal Act on Collective Investment Schemes or a similar law or regulation. The complete information on the certificate, including the relevant risks, can be obtained from the simplified prospectus, which can be retrieved from www.ubs.com/keyinvest and which constitutes the sole binding basis for an investment decision. The Document is for general informational purposes only. Nothing contained in this Document constitutes legal, tax or investment advice. The information in this Document does not constitute an offer, solicitation or recommendation to buy or to sell the certificate or any other financial instruments, or to engage in any other transaction involving financial instruments. Before making an investment decision the Recipient should always read all relevant legal documents (e.g. the simplified prospectus) as well as any other material which might be required under local laws and regulation, especially all relevant risk disclosures contained therein, and seek professional advice. Any investment decision lies in the sole responsibility of the Recipient. Past performance is no guarantee for future performance. HCP provides no guarantee whatsoever pertaining to the future performance of the certificate. Although the Document is based on information that HCP considers to be reliable, HCP does not guarantee that the content is accurate, up-to-date or complete. HCP may amend the Document partly or entirely at any time without prior notice. HCP is not obliged to provide the Recipients with an amended version of the Document.

0 Comments

Leave a Reply. |

AuthorBolko Hohaus Archiv

December 2023

Categories |

||||||

RSS Feed

RSS Feed